What is market cap in crypto

FEATURED SERVICES

Crypto assets have been around for more than a decade, but it’s only now that efforts to regulate them have moved to the top of the policy agenda. This is partly because it’s only in the past few years that crypto assets have moved from being niche products in search of a purpose to having a more mainstream presence as speculative investments, hedges against weak currencies, and potential payment instruments. Understanding market cap crypto By Current Software

What does crypto market cap mean

In an effort to demystify crypto for mainstream audiences, the industry appropriates terms from traditional finance. For instance, lending firms such as BlockFi, Gemini, FTX and plenty of others used words such as yield or interest in marketing materials in an effort to convince investors that depositing assets in these platforms were akin to banking savings accounts. Understanding Cryptocurrency Market Capitalization: Crypto Market Cap Explained From 8 October 2023, however, the marketing of crypto is now regulated, and you can help protect yourself by recognising regulated crypto marketing.

What Does Market Capitalization Mean in Crypto?

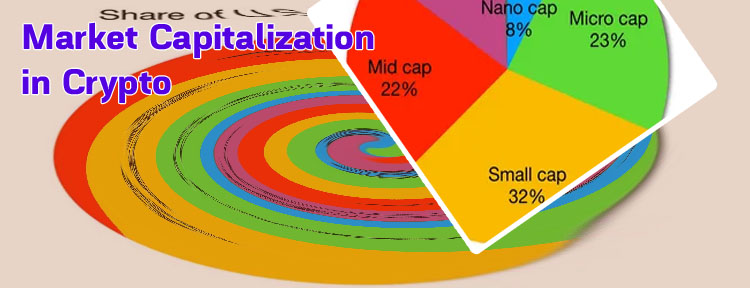

In just over two months, the market capitalization of the cryptocurrency market has doubled, according to price tracking website CoinGecko, as retail and institutional investors pile into the space. Read more about “Market cap created the perfect tool to attract newbies by artificially inflating the numbers. They mine 1 million coins they release a thousand in reality which they can buy for 10$ a piece. And suddenly that crapcoin has a 10 million market cap and noobs flock. And in one week time, most of them get fleeced.” — Unknown

How is market cap calculated crypto

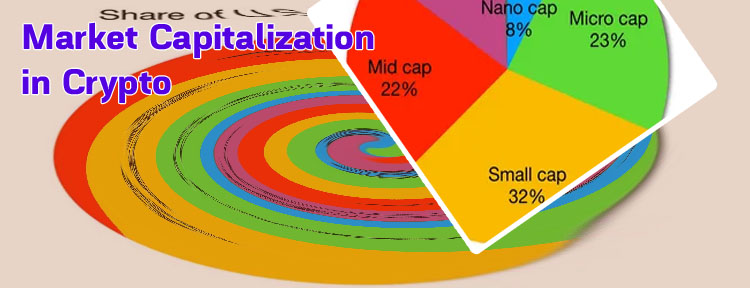

Based on market cap, a cryptocurrency can be put into three main categories: Large-cap, mid-cap, and small-cap (low-cap). Editorial disclosure As always with cryptocurrencies, we recommend to do thorough research before investing and consider all vital factors involved. For instance, market cap as a metric doesn’t say much about actual trading volumes over the last couple of hours. Therefore it makes sense to also check Coinmarketcap for the 24-hour trading volume that a cryptocurrency has on different exchanges over a reasonable period and other essential criteria before investing.